France, India and Australia have overtaken the UK in Ernst & Young’s (EY) latest Renewable Energy Country Attractiveness Index (RECAI).

The annual Index placed the UK in seventh place, down by three on the previous year. EY said this was due to the “failure of Contracts for Difference (CfD) Round 5 to attract new offshore wind capacity, plus the diminishing of green policies which has left investors with reduced confidence in UK renewables”.

Indeed, the UK’s diminishing of green policies has left a sour taste for many within the energy industry. Delays such as the ban on fossil fuel vehicle sales and decarbonised heating have lowered the country’s credibility in tackling climate change.

Although it could be argued that various positive legislations have been introduced, such as the increase in the heat pump grant to £7,500 via the Boiler Upgrade Scheme, the inconsistencies with green policies coming from the government have now lowered investor confidence in the UK market.

Not only has this lowered investor confidence but it has also put the mandated 2050 net zero target “in jeopardy” according to the Public Accounts Committee. The organisation stated in a new report that a lack of long-term planning by the government has contributed to this alongside inconsistent policies.

Despite these negatives, EY did outline that the new planning permission and incentives for onshore wind projects offer some hope in attracting investment.

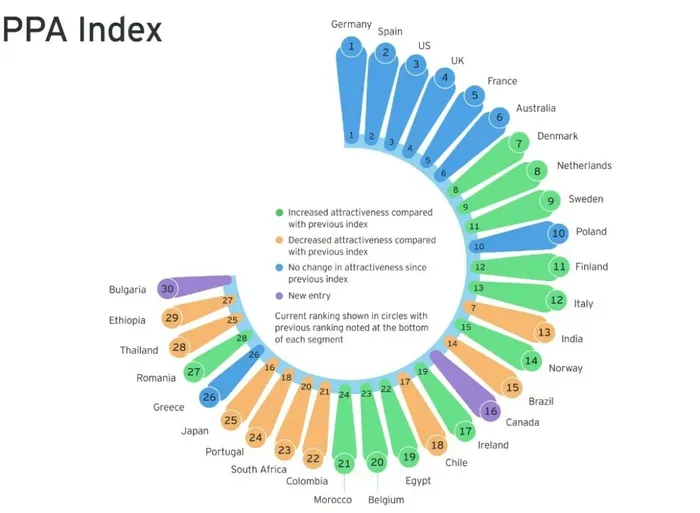

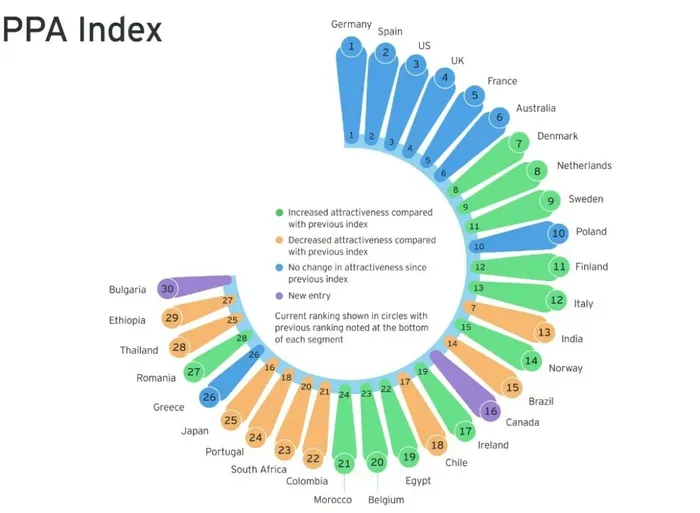

It is worth noting that the UK remained fourth in the rankings for the power purchase agreement (PPA) Index only bested by Germany, Spain and the US.

Ireland sees rise in rankings thanks to ORESS-1 auction

The Republic of Ireland ranked 12th in this year’s RECAI, moving up one place from the 13th place it was awarded last year. In doing so, the country has leapfrogged Japan.

EY highlighted that the success of its first Offshore Renewable Electricity Support Scheme (ORESS-1) auction, which saw over 3GW awarded for offshore wind projects, contributed to this rise in the rankings.

The auction results “surpassed expectations” according to the Irish government both in terms of the total volume of renewable energy that has been procured and the low price at which it has been secured. The competitive price secured at an average of €86.05/MWh (£74.85/MWh) and is recognised as one of the lowest prices paid by an emerging offshore wind market in the world, the government said at the time.

EY’s Index also highlights further positives for Ireland. In the “normalised RECAI ranking” Ireland sits sixth behind Denmark, Morocco, Greece, Australia and Chile.

The organisation explained that the RECAI uses various criteria to compare the attractiveness of renewables markets, such as the magnitude of the development pipeline, that reflect the absolute size of the renewable investment opportunity.

Because of this process, the Index naturally benefits large economies. By normalising with the gross domestic product (GDP), EY stated you can see which markets are performing above expectations for their economic size. In this way, the normalised Index helps reveal ambitious plans in smaller economies, creating some attractive alternatives for potential investors. To rank in at sixth on this list is a testament to the forward-thinking development of the Irish renewable sector.

.png?width=700&auto=webp&quality=80&disable=upscale)